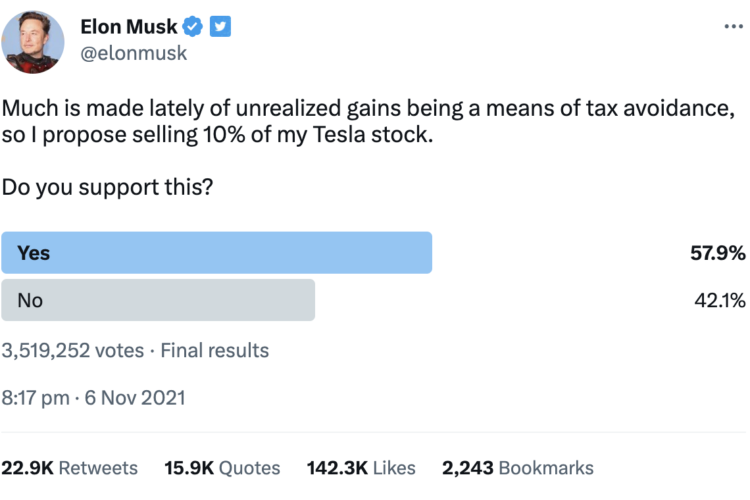

In case you missed Prof. Dr. Dr. Dietmar Janetzko interview with Ard Tagesschau, you can find the full video below. Prof. Dr. Dr. Dietmar Janetzko covers the inner workings of the Meme Stock trend and provides a nice overview of the effect it has on the retail investor community and financial markets in general. We would like to thank Ard […]