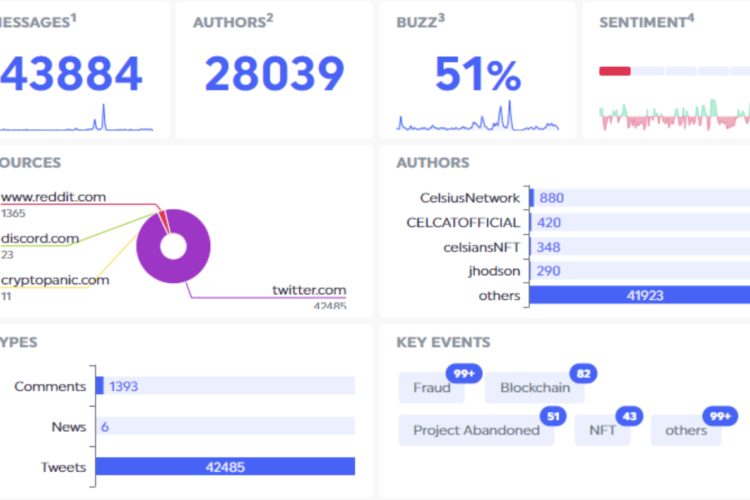

Most people will not hesitate to put an equation sign between Social media success and business success. After all, a big social media footprint seems to be a key requirement for the success of the business as a whole. In what follows, we challenge this notion on the basis of data sourced by Stockpulse. Informed […]