Are Meme Stocks just another form of Pump & Dump, or is there something more going on?

Ever wondered what drives the wild ride of Meme Stocks? Here’s a quick breakdown of the “Meme Stock Cycle”:

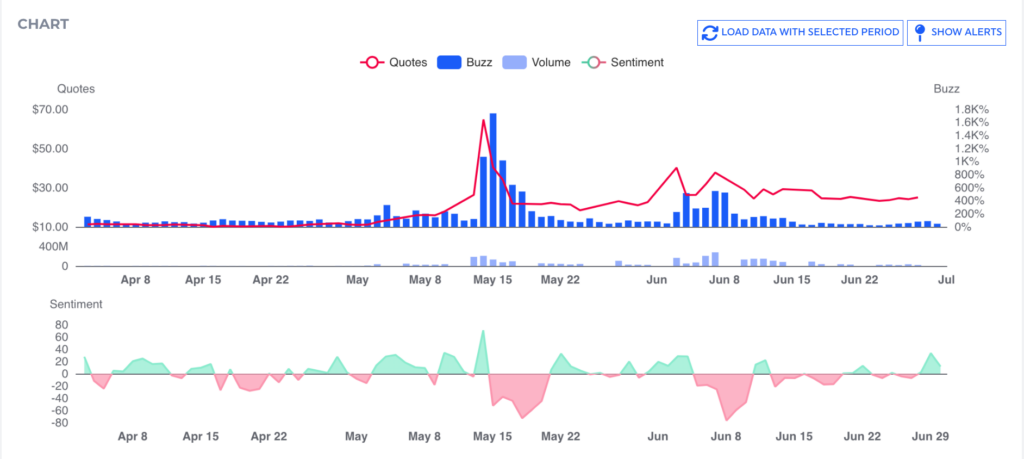

1. Early-Adopter Phase:

A few investors spot an undervalued stock and start buying. They also begin promoting it on social media, trying to spark a broader interest. The price starts to rise slightly.

2. Middle Phase:

More investors notice the uptick in volume and join in. The stock gains momentum, and the early promoters continue to hype it online, fueling the growing interest.

3. Late/FOMO Phase:

Social media buzz intensifies. Fear of missing out (FOMO) drives a surge of small investors to buy, causing the price to skyrocket.

4. Profit-Taking Phase:

Early investors sell to lock in gains, triggering a sell-off. The price drops sharply, and panic sets in.

5. New Cycle Setup:

The stock stabilizes at a new base price, setting the stage for a potential repeat of the cycle.

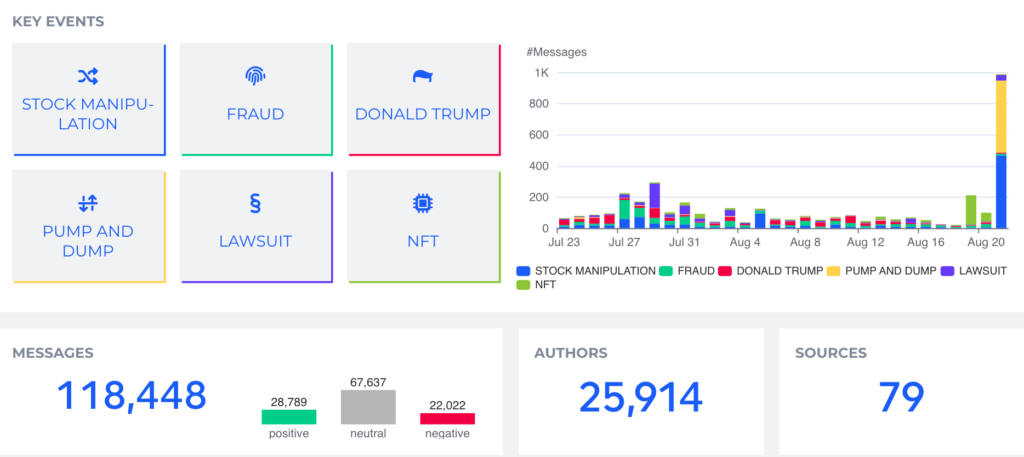

Traditional Pump & Dump schemes prey on a small, inexperienced group, manipulating them for quick profits.

In the case of Meme Stocks, we’re seeing something similar – but on a much larger scale, driven by social media.

Can a massive online community really be manipulated in the same way? Or is it different when so many people genuinely believe in the stock’s potential?

Is it still Pump & Dump if it’s the collective force of a large group?

It’s a fascinating and complex issue with no easy answers. What do you think? Is this the new face of market manipulation, or simply the power of social media at work?