Over the last three years, Discord has tripled its number of active users from 56 million in 2019 to 150 million in 2022. But the social platform headquartered in San Francisco does not only boast a “explosive popularity” (TechCrunch). It is also one of the key platforms for financial debates. Both aspects together make the data extracted from discussions on Discord very relevant for understanding developments on global financial markets.

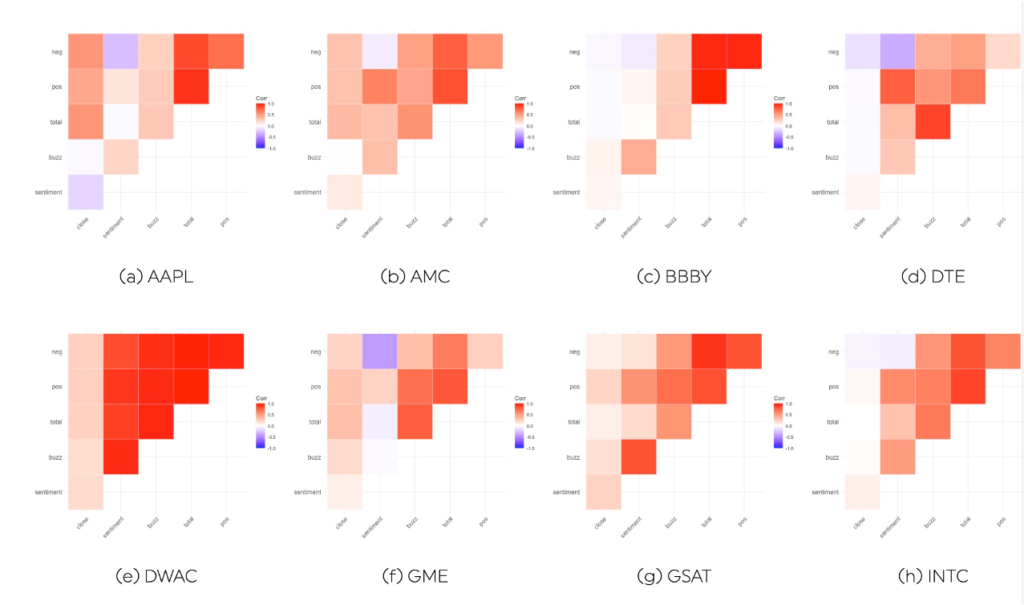

In a brand new study we investigated whether this data has the potential to trigger movements on the financial markets. To answer this question, the report focuses on Granger causality analysis and estimates associated effect sizes (partial eta squared). Among the main findings are that discussions on Discord have stronger effects on stocks than on crypto assets and that a positive correlation between positive sentiments and close rate, was necessary but not sufficient for a significant effect of Granger causality.

If you want to read the full white paper please request it via the button below.