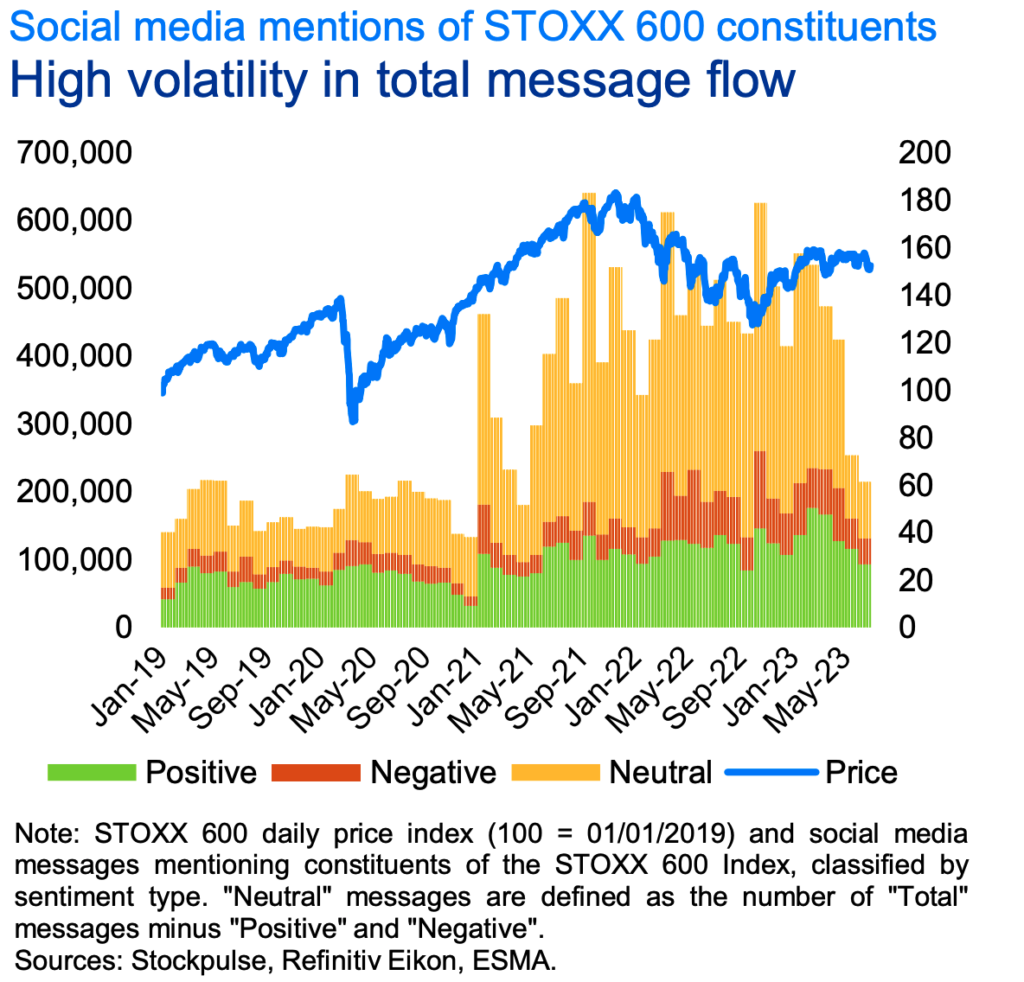

A recent study by ESMA (Lorenzo Danieli and Tania De Renzis) investigates the relationship between social media data and stock prices. The study is built on data harvested by Stockpulse.

On social media platforms, investors are nowadays able to share information, opinions and views at a large scale in real time. The quality and validity of information shared by individuals in that way cannot be taken for granted. In this respect, social media posting differs fundamentally from journalism: specialised financial media are held accountable for the accuracy of the information they report.

This is not necessarily the case for social media. The impact of social-media information in securities markets is, therefore, a growing market and public policy concern. Increasing social media interactions and related sentiment among investors influence the collective investor behaviour with potential effects on financial market dynamics. This comes with notable risks for retail investors raising investor protection concerns. It may also involve wider market movements with systemic implications, increasing financial stability concerns.

Against this background, this article investigates the influence specifically of social media activity and sentiment on stock prices. The main findings identify only a transitory effect of social media sentiment on stock excess returns. Positive social media sentiment seems to be correlated with higher returns in the very short-term.

In this sense, information spreading on social media platforms may affect investor trading choices and may amplify daily market movements. However, price overreaction typically does not last more than one day and is only transitory. This points to the risk of investors excessively relying on social media news whose truthfulness and accuracy is difficult to verify.

If you are interested in the full paper you can access it here.