During the course of the past few months we were intensively looking into the application of Deep Learning on our emotional data for financial markets. Initial results of our research work are beyond everything we have seen so far. It is a combination of our experience gathered during the past 10 years of applying large scale analytics to emotional data, learnings from errors and success stories, deploying one of the longest data histories of emotional sentiment data, powerful technologies and hardware, and an exceptional creativity of designing new algorithms.

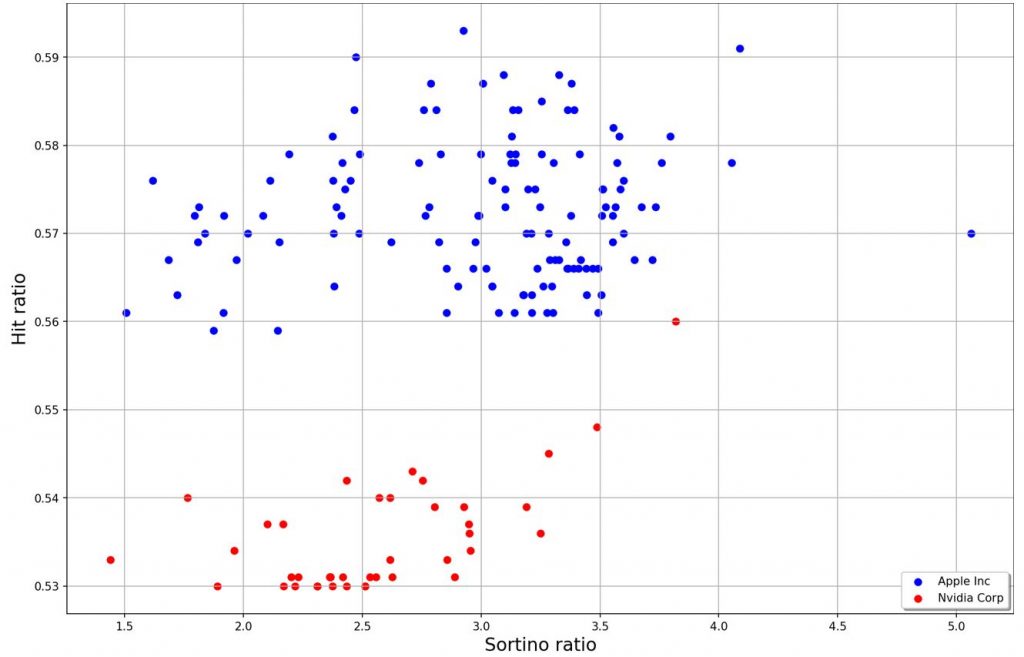

This research effort is a further great example of how predictable market movements are when Machine Learning plays its role in data analytics. Initially, we wanted to gain a better understanding of how emotional data can predict Long and Short decisions on a daily basis. We have chosen two famous stocks which are strongly discussed within the internet community: Apple Inc. (ticker: APPL) and NVIDIA Corp. (ticker: NVDA). In the first step we defined a set of criteria which limited the number of applicable models. We were only interested in models which have met our standards expressed in common financial performance criteria. In the second step we chose the way how to train the neural network in a reasonable amount of time, as the number of possible configurations of stock prediction neural networks is huge. We decided on using genetic algorithms for training purposes which helped to optimize the neural net’s structure. The genetic algorithm is a concept inspired by Charles Darwin’s theory of evolution. It follows the principle of natural selection where the fittest individuals are selected to produce offspring of the next generation. Each neural network’s performance was evaluated with our proprietary back testing platform.

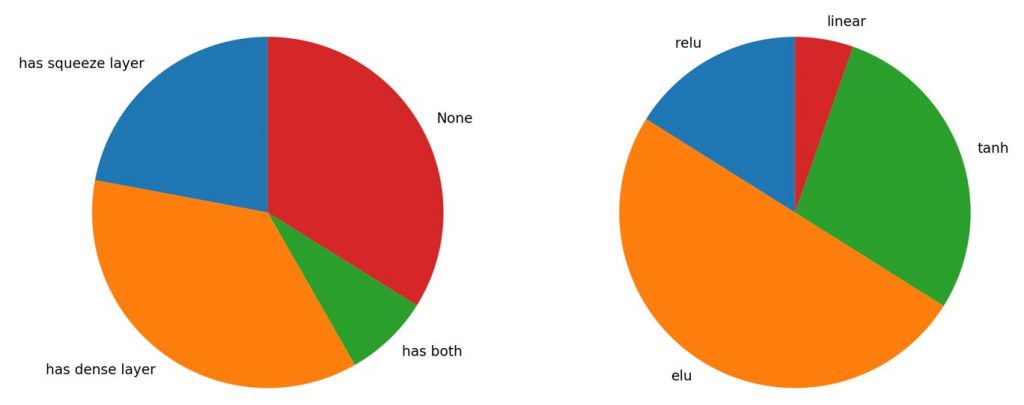

Here are some results: This figure shows the correlation between hit ratio and Sortino ratio whereby each point represents a model. The pie charts afterwards show the distribution of layer types and activation.

If you want to know why the results of this research are far beyond everything we have seen before, please get in touch and drop us a note.