Real-Time Social Sentiment for Smarter Financial Decisions

Stockpulse.AI helps financial institutions to make more informed decisions by monitoring social media and extracting actionable insights.

Get Free Trial

Our Clients and Worldwide

Financial Partners

Deutsche Börse AG leverages social media monitoring for trading surveillance, using advanced AI to

detect market manipulation, fraud, and anomalies in real-time, enhancing regulatory compliance and market integrity.

Moody’s utilizes our AI-generated summaries for financial instruments, leveraging our daily output

of thousands of concise reports to enhance market analysis, risk assessment, and decision-making with real-time insights.

Refinitiv utilizes our AI-generated summaries for financial instruments, leveraging our daily output

of thousands of concise reports to enhance market analysis, risk assessment, and decision-making with real-time insights.

Interactive Brokers integrates our AI-driven sentiment analyses for stocks into daily reports and

updates, providing clients with real-time market sentiment insights to support informed trading decisions.

Bursa Malaysia leverages social media monitoring for trading surveillance, using advanced AI to

detect market manipulation, fraud, and anomalies in real-time, enhancing regulatory compliance and market integrity.

Newstex is a news syndication platform that helps us as an intermediary to distribute our daily

output of thousands of AI generated articles.

Global Tier-1

Quantitative Hedge Funds

Quantitative hedge funds leverage our Buzz and Sentiment data for alpha generation and risk

management, using real-time market sentiment insights to refine trading strategies and mitigate investment risks.

BurdaForward integrates our AI-generated summaries, Buzz, and Sentiment values for stocks into their

Finanzen100 app, delivering real-time market insights and trends to enhance user investment decisions.

Global Tier-1

Stock Exchanges

Some of the biggest stock exchanges of the world leverage our social media monitoring for trading

surveillance, using advanced AI to detect market manipulation, fraud, and anomalies in real-time, enhancing market integrity.

European Regulators

Regulators utilize social media monitoring for market surveillance, detecting fraudulent activities,

market manipulation, and emerging risks in real time to ensure transparency, compliance, and stability in financial markets.

Financial Publishing Companies

Financial publishing companies utilize our social media monitoring and AI solutions to develop new

products, generate leads, and deliver real-time market insights, enhancing audience engagement and revenue opportunities.

Global Tier-1

Private Equity Firms

Private equity firms leverage our social media monitoring to enhance deal sourcing and investment

decisions, identifying emerging opportunities, market trends, and sentiment shifts in real time for better strategic insights.

Being part of the Nvidia Inception Program helps us to get access to tools and training for AI

developers and preferred pricing on NVIDIA hardware.

Beyond Fundamental Analysis

By Monitoring

Social Media

Social Media

Using Accurate Sentiments

Generating

Leading Indicators

and Actionable

Alerts

Leading Indicators

and Actionable

Alerts

Stockpulse's Strength

Speed

- Data is collected and processed in real-time

- Crawlers are monitoring thousands of sources continuously

- Entity matching, NLP, database operations only take milliseconds

Stability

- Infrastructure is unique and built proprietary

- All systems have a triple redundancy

- Full control of all processes

History

- 14 years of data

- Collected continuously, data was not backfilled

- Unique datasets and broad source coverage

Customization

- Adjust to individual preferences

- Build custom solutions

- Great flexibility

Unparalleled Coverage

0M+

Messages Daily0M+

Diversified Sources0 Years+

Historical Data0B+

Total Messages Collected0k+

Equities Globally0+

Markets Globally0+

Regions0+

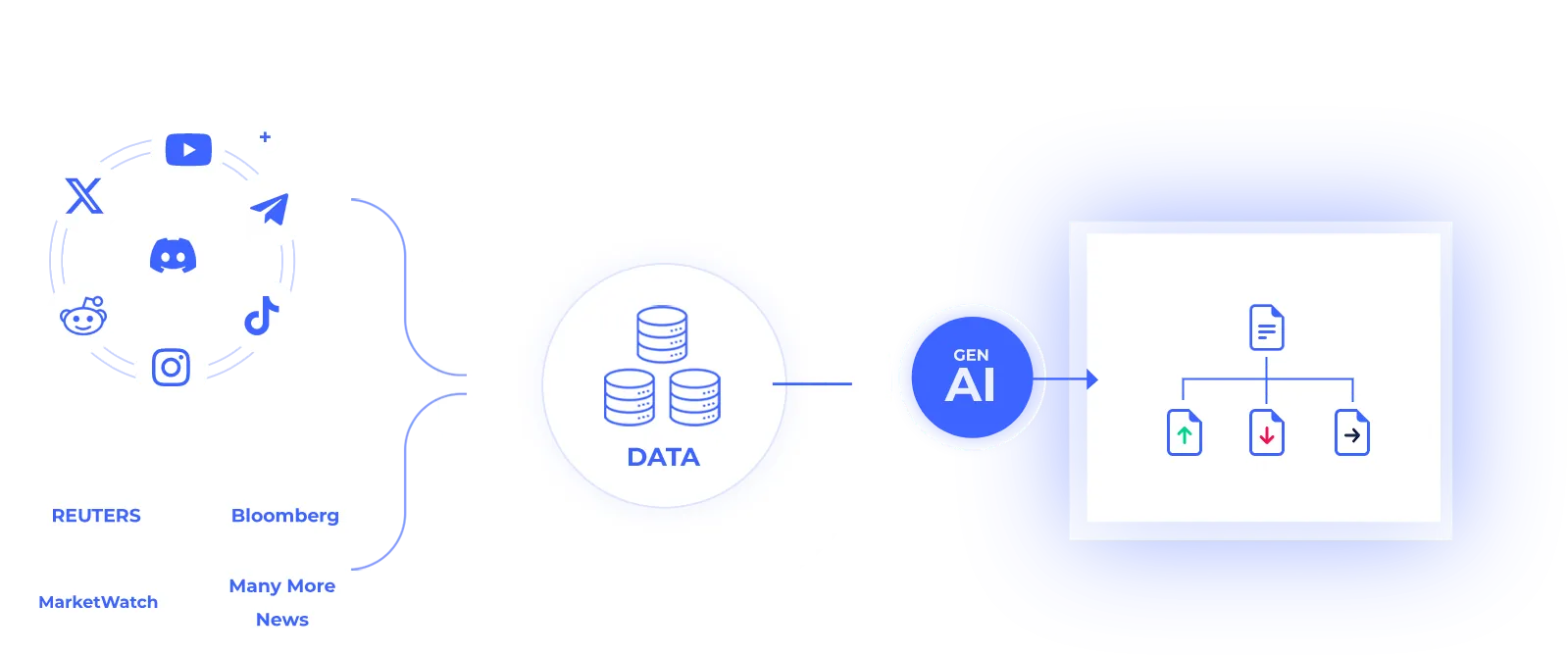

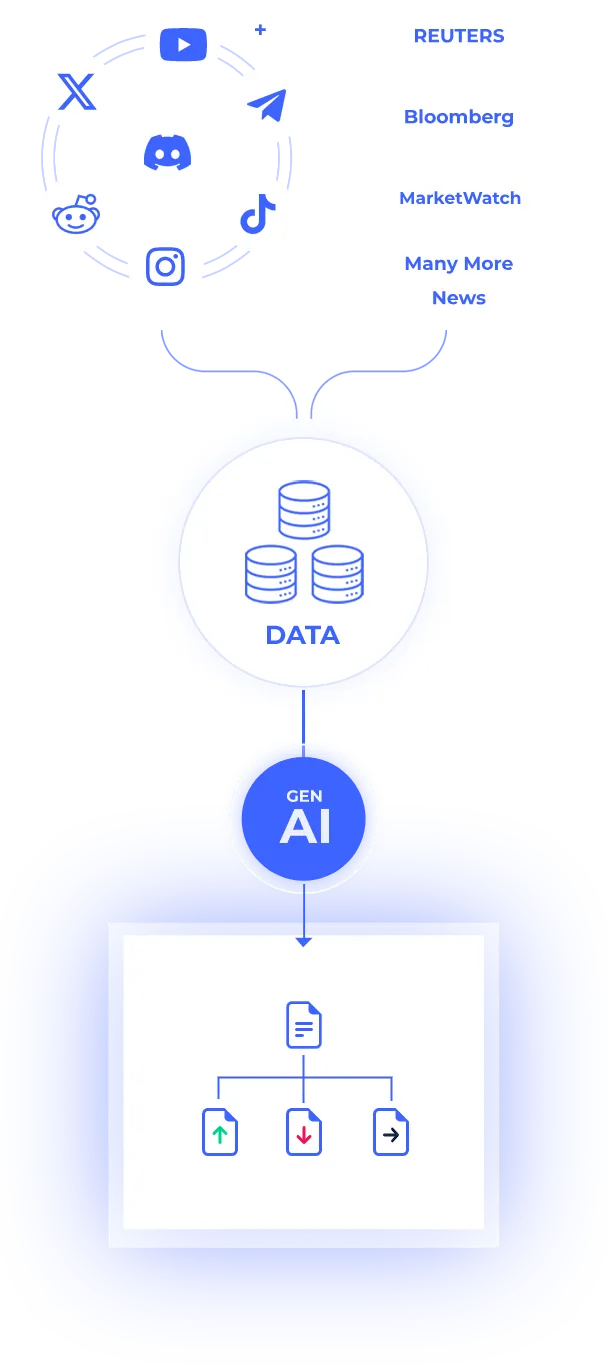

Key EventsAI-Powered Insight Pipeline

- Crawl Social Media

and News - Store &

Structure Data - Augment Data

with AI - Prediction/

Outlook

Stockpulse's Key Benefits

Optimized for

Financial Markets

Accurate

Stock Ticker

Mapping

Long

History and

Point-in-Time Data

Calculating

Accurate

Sentiments

Building

Customized

Views

Providing

Real-time API

integration

Use Cases

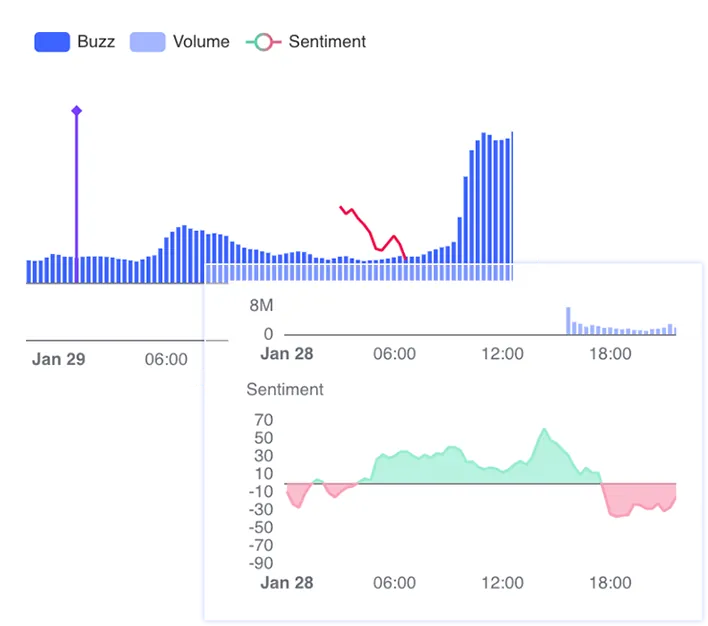

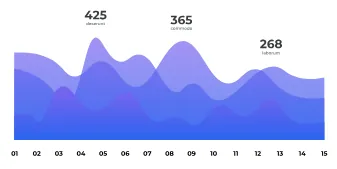

Generate Alpha with Social Buzz

- Identify patterns in social buzz and use contextual sentiment to derive actionable trading signals.

- Use extensive historical data sets and point-in-time data to find out the best correlations.

Detect Pump & Dump Early

Identify possible pump & dump schemes early based on suspicious buzz in social media.

Learn Moreabout detecting pump & dump early

Learn Moreabout detecting pump & dump early

Generate Insights with Social Buzz

- Early Identification of Emerging Trends and Investment Opportunities

- Real-Time Market Sentiment on Portfolio Companies

Empower

Investment Decisions

with Social Monitoring

Gain real-time market insights with social monitoring and enhance your investment strategy today. Contact us to learn more!